Car And Truck Expenses Worksheet 2018

Recordkeeping requirements the general rule is that taxpayers have to keep records to support deductions taken on their tax returns. The reimbursement you deduct and the manner in which you deduct it depend in part on whether you reimburse the expenses under an accountable plan or a nonaccountable plan.the best free tutors worksheets

27 Car And Truck Expenses Worksheet Worksheet Information

I traded in an older car for a new car for my business.

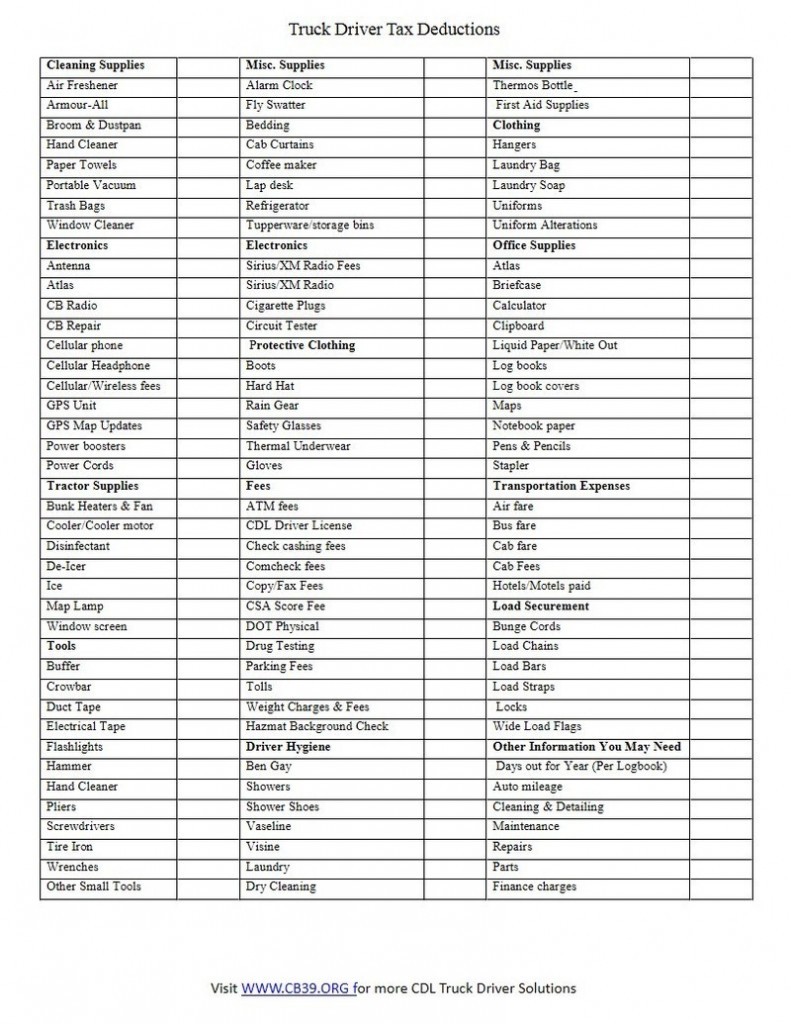

Car and truck expenses worksheet 2018. Turbotax did and it still says it is too high. Trucker’s expenses (continued) equipment purchased radio, pager, cellular phone, answering machine,. It is $0.545 per mile for 2018.

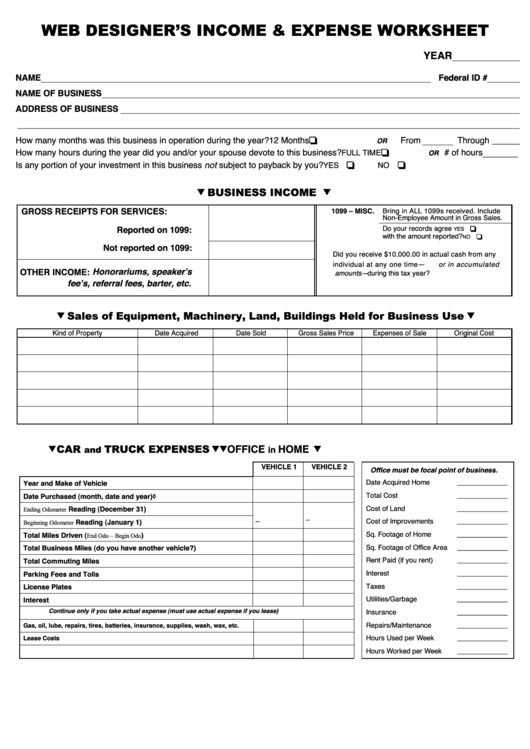

Schedule c car and truck expenses worksheet cost. Kind of property date acquired date sold gross sales price expenses of sale original cost car and truck expenses (personal vehicle). 50 luxury rental property tax deductions worksheet documents ideas.

For 2020, the rate is 57.5 cents per mile. Also use schedule c to report a wages and expenses you had as a statutory employee b income and deductions of certain qualified joint ventures and c certain income shown on form 1099 misc miscellaneous income. You cannot also claim lease payments, fuel, insurance and vehicle registration fees.

Schedule c car and truck expenses worksheet lovely small business. With the mileage rate, you won’t be able to claim any actual car expenses for the year. There is no drop down menu to override it and i did not put in a depreciation value.

Tax year 2018 3 car and truck expenses o you may deduct car/truck expenses for local or extended business travel, including: For most taxpayers who incur car and truck expenses for work, the standard mileage rate produces a larger deduction. From worksheet on next page $_____ commissions & fees paid to others $_____ contract labor $_____ did you pay $600 or more in total during the year to any individual?

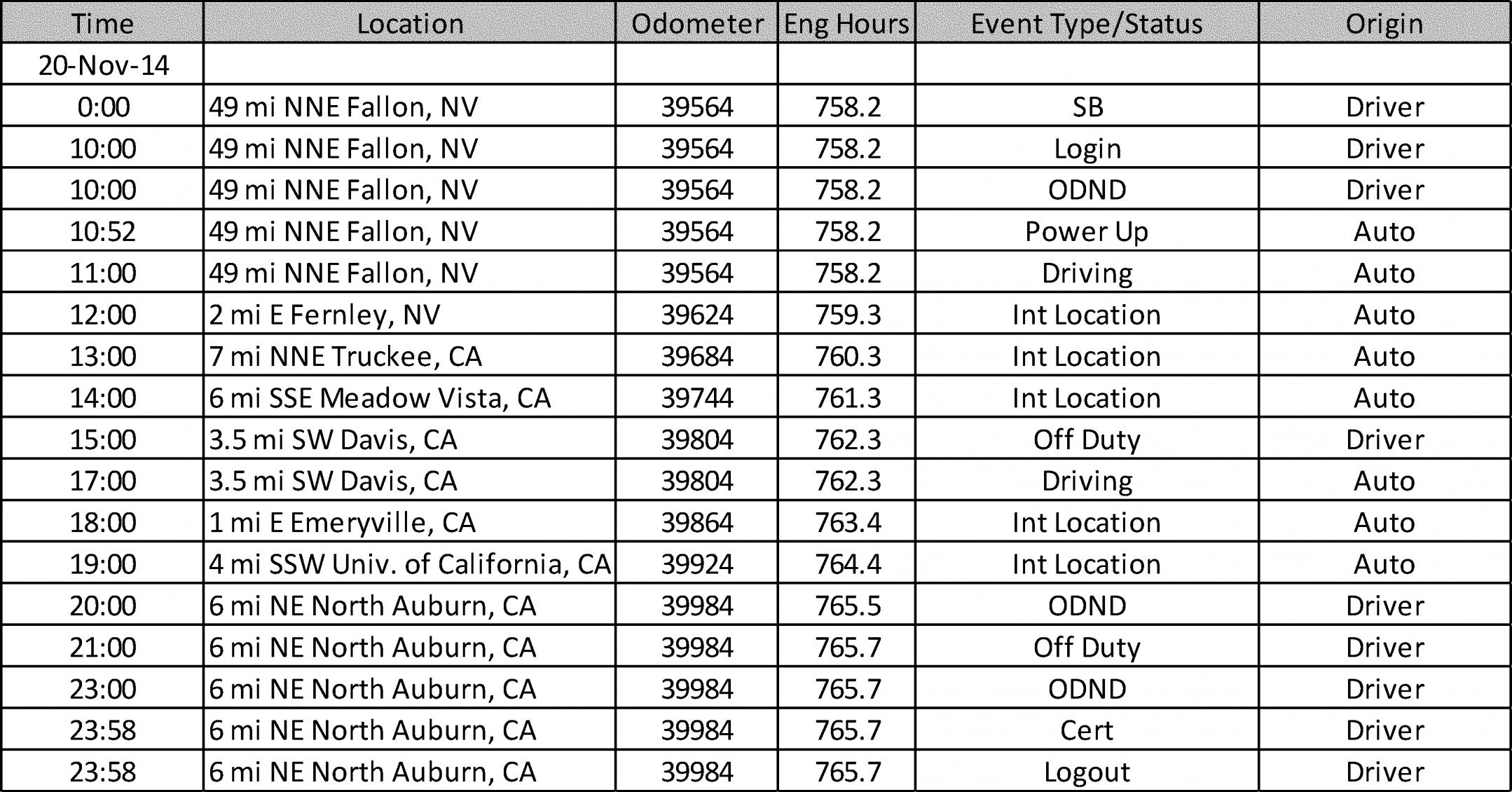

Trucker’s income & expense worksheet. If you claim any car and truck expenses,. 2018 2018 tax year car and truck expense worksheet vehicle information vehicle 1 vehicle 2 vehicle 3 complete for all vehicles 1.

You have two options for deducting car and truck expenses. 2018 2018 tax year car and truck expense worksheet vehicle information vehicle 1 vehicle 2 vehicle 3 complete for all vehicles 1. Overstated adjustments, deductions, exemptions and credits of all types account for more than

Business may 29, 2018 no comment. Make & model of vehicle. Also, if you use your vehicle for both business and personal use, you can deduct only the business miles.

Also use schedule c to report a wages and expenses you had as a statutory employee b income and deductions of certain qualified joint ventures and c certain. Total auto mileage expense car and truck expense calculator gasoline, lube, oil repairs tires insurance inventory method mark “x” below cost lower of. 2017 2017 tax year car and truck expense worksheet vehicle information vehicle 1 vehicle 2 vehicle 3 (complete for all vehicles).

31 car and truck expenses worksheet. Itemized fee worksheet excel save btsa co. Vehicle expense worksheet (if claiming multiple vehicles, use a separate sheet for each) required for all claims:

Car and truck expense worksheet general info vehicle 1 vehicle 2 * must have to claim standard mileage rate dates used if not for the time period description of vehicle * date placed in service* total business miles* total commuting miles* other miles* total miles for the period* Sch c wks car amp. Also use schedule c to report a wages and expenses you had as a statutory employee b income and deductions of certain qualified joint ventures and c certain income shown on form 1099 misc.

Use this worksheet to figure the amount of expenses you may deduct for a qualified business use of a home if you are electing to use the simplified method for. Between one workplace and another, to meet clients or customers, to visit suppliers or procure materials, to attend meetings, for other ordinary and necessary managerial or operational tasks or • do you have any other vehicle available for personal use?

I have tried all of this and it does not work. 2020 2020 tax year car and truck expense worksheet vehicle information vehicle 1 vehicle 2 vehicle 3 (complete for all vehicles) 1. A) gasoline, oil, repairs, insurance, etc.

Nl.pinterest.com adhere to the instructions about what to edit. Enter the amount from your last form 8829, line 43 (line 42 if before 2018). 2018 schedule c car and truck expenses worksheet worksheet schedule c (form 1040) 2018.

Yes no • do you have written mileage records to support your deduction? Only actual passenger vehicle operating expenses are permitted This rule applies to car and truck expenses.

Small business income and expense worksheet and self employed tax. Car and truck expense deduction reminders. You can use your actual expenses, which include parking fees and tolls, vehicle registration fees, personal property tax on the vehicle, lease and rental expenses, insurance, fuel and gasoline, repairs including oil changes, tires, and other routine maintenance, and.

2018 schedule c car and truck expenses worksheet.

Download 52 Itemized Deductions Worksheet Picture Free

Car And Truck Expenses Worksheet Escolagersonalvesgui

Download 52 Itemized Deductions Worksheet Picture Free

Schedule C Expenses Spreadsheet Schedule C Car And Truck

Car And Truck Expenses Worksheet Nidecmege

Irs Auto Expense Worksheet Printable Worksheets and

Vehicle Repair Log Templates 10+ Free Word, Excel & PDF

2018 Schedule C Car And Truck Expenses Worksheet

33 What If Worksheet Turbotax Free Worksheet Spreadsheet

Truck Driver Expense Spreadsheet Free Spreadsheets

27 Car And Truck Expenses Worksheet Worksheet Resource Plans

Download 52 Itemized Deductions Worksheet Picture Free

Excel Templates Medical Expense Spreadsheet Templates

2018 Schedule C Car And Truck Expenses Worksheet

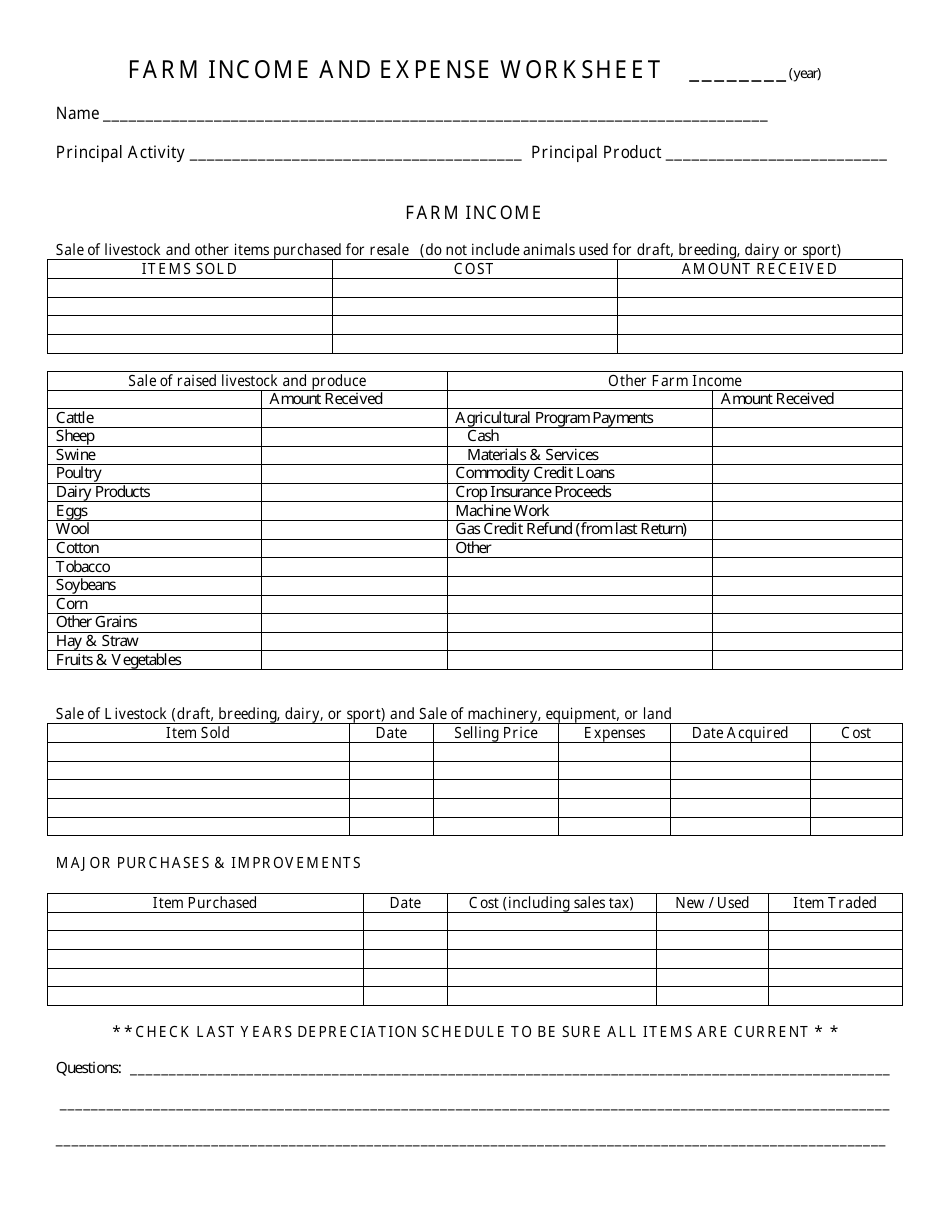

Farm And Expense Worksheet Worksheet List

Trucking And Expense Spreadsheet Awesome Trucking

Car And Truck Expenses Worksheet Escolagersonalvesgui

27 Car And Truck Expenses Worksheet Worksheet Resource Plans